B2B Buying Signals: How to Build a Smart System to Capture Them

In modern B2B sales, signals have become the gold dust of prospecting. They’re the subtle clues that someone — a company or a decision-maker — might soon need your product. Those who learn to detect and act on them first, win.

Why everyone is talking about signals

The reason signals are such a hot topic now is simple: attention is scarce, and outreach fatigue is real. Most buyers today ignore cold messages unless the timing is perfect. That’s why sales teams who react to a signal within hours can outperform slower competitors by a huge margin.

Recent B2B studies show:

- Responding within 24 hours of a buying signal can increase the chance of conversion by up to 60%.

- Waiting more than three days drops win probability by 35–50%.

- Companies using structured signal systems report 28% shorter sales cycles.

Signals aren’t magic — they’re a timing advantage.

Where to store and manage them

A dedicated system is key. For small teams, a spreadsheet or Notion board might work at first, but scaling requires automation.

Recommended structure:

- CRM integration (HubSpot, Pipedrive, Salesforce) — each signal is logged as an “activity” tied to an account.

- Custom fields: Signal type, detected date, urgency score, and source (LinkedIn, job boards, tech tracker, etc.).

- Automated alerts: If no action is taken within X hours, the system pings the responsible sales rep.

- Weekly review: Sales + marketing align to discuss recurring trends (“We’ve seen 10 hiring signals from fintechs this month”).

Speed and consistency are everything. If your CRM can’t automate notifications, use tools like Zapier or Make to bridge the gap.

Signals decay faster than milk,” one sales manager joked. “After 72 hours, they’re usually gone.

Common types of buying signals

Not all signals are created equal. The basic ones include:

- Website engagement: frequent visits, pricing page views, demo requests.

- Email activity: clicks or replies to outreach campaigns.

- Social interactions: likes or comments on posts, new followers from target companies.

- Company news: funding announcements, expansions, or leadership hires.

These are valuable, but easy to track — which means everyone tracks them. Competitive advantage lies in the sophisticated signals most teams overlook.

Advanced, high-value signals

Let’s go deeper into the data that truly predicts intent.

-

Job postings analysis When a company posts roles like “Sales Enablement Manager” or “CRM Administrator”, it suggests they’re investing in new tools or restructuring processes. If you sell SaaS or automation, that’s your moment. Tools like Apollo, Clay, or LinkedIn automation can scrape these updates and feed them into your CRM daily.

-

Tech stack changes Using services like BuiltWith or Wappalyzer, you can detect when a company adds or removes technologies. For example, a firm dropping HubSpot for Salesforce is a clear buying signal for integration services.

-

Budget movements or procurement activity Large B2B buyers often leave traces through RFPs, tender portals, or updated vendor lists. Set alerts for your niche and have AI summarize relevant entries.

-

Leadership or org chart shifts A new Head of Marketing or CTO often comes with new priorities — and new vendors. Reaching out within 7 days of such a change can raise your response rate by 40%.

-

Product updates or public roadmap mentions If a SaaS company just launched a new module or feature, partners in that ecosystem (e.g., agencies, consultants) can reach out immediately with tailored proposals.

-

Event participation Attendance at webinars, trade shows, or niche conferences signals active market exploration. Connect after the event with personalized takeaways.

Signals specific to B2B SaaS and digital agencies

For SaaS startups and agencies, some signals are especially potent:

- Website signups without conversion → strong retargeting opportunity.

- Trial expirations → instant follow-up trigger.

- API documentation traffic spikes → indicates deeper product evaluation.

- Competitor mentions in forums or review platforms → track them and respond discreetly.

- LinkedIn hiring for roles that complement your service → open doors for partnerships.

A simple AI-enhanced Make scenario can monitor all of the above: scrape job boards, detect tech changes, and notify a sales channel in Slack or email with “hot” accounts of the week.

We built our entire pipeline from signal alerts,” said a SaaS founder. “Once we started reacting within hours, our close rate rose by 32%.

Turning signals into meetings

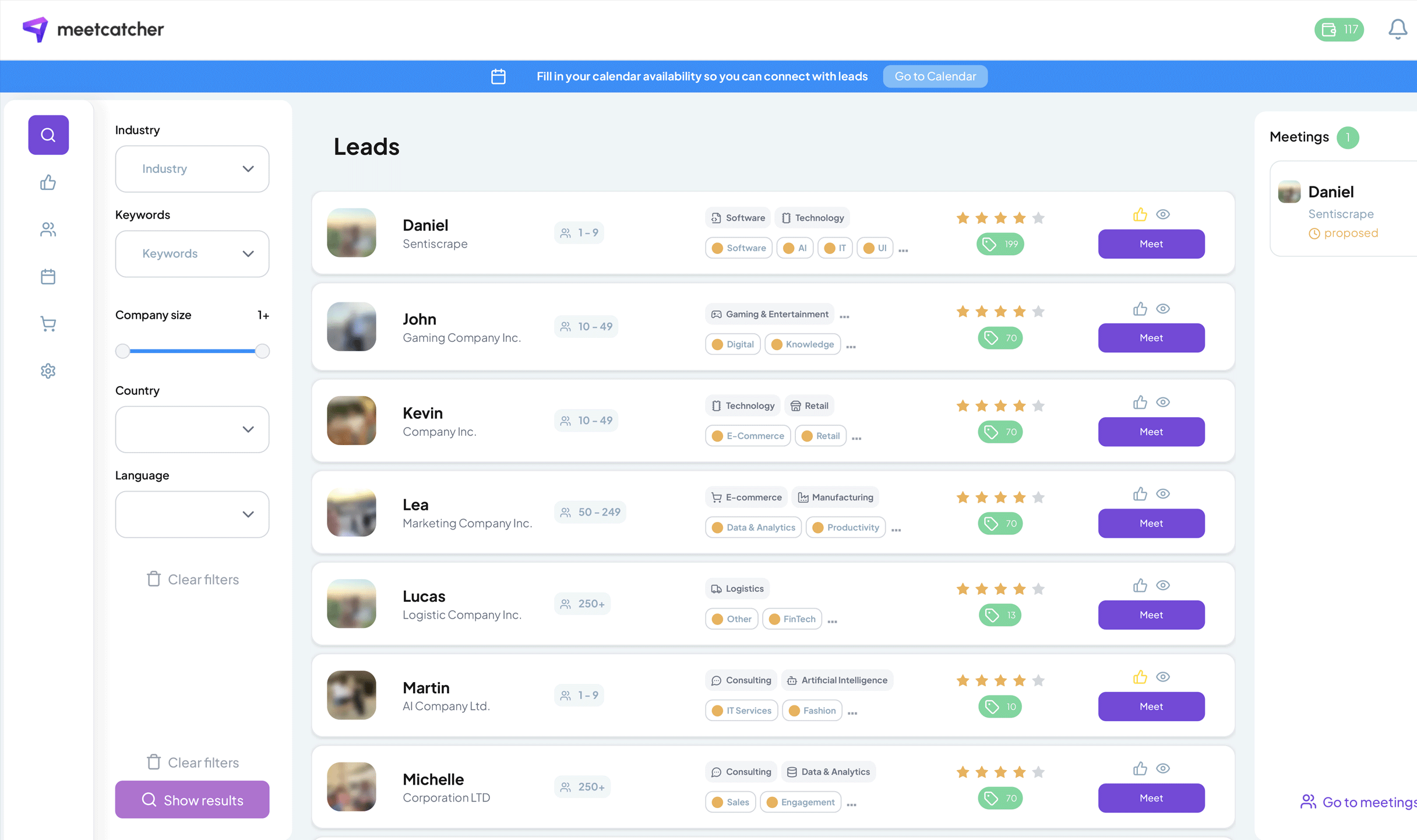

Capturing signals is only half the battle — the win happens when you turn that intent into conversation. That’s where tools like Meetcatcher make the process effortless.

Meetcatcher allows you to instantly reach out to potential B2B customers showing buying intent and schedule short, structured video meetings with them. Instead of waiting for inbound leads or chasing cold contacts, your team can go straight from detected signal to confirmed conversation — all within a single day.

Speed matters. Signals fade fast — but with the right system and a direct path to dialogue, they can fuel exponential sales growth.

Final thought

Signals are today’s B2B compass. They don’t replace outreach — they amplify timing. Build your system, react fast, measure impact, and never let a hot signal cool before turning it into a human conversation.