How to Calculate Customer Acquisition Cost in B2B

Understanding how much it costs to acquire a new customer is one of the most critical — and misunderstood — parts of B2B growth. The number might look simple on paper, but behind it lies a mix of marketing, sales, brand, and human effort that’s easy to underestimate.

The CAC formula — and why it matters

At its core, Customer Acquisition Cost (CAC) measures how much you spend to gain one paying customer. The general formula looks like this:

CAC = (Total Marketing + Sales Costs) ÷ Number of New Customers Acquired

In B2B, you should include not just ad spend, but also:

- salaries of your marketing and sales teams,

- cost of tools (CRM, automation, analytics),

- branding and content creation,

- events, email campaigns, and even cold calling time.

Only when you include all of these do you see the true cost of winning a new client.

A healthy CAC ratio (LTV/CAC) is typically 3:1 or higher, meaning each client should generate at least three times what they cost to acquire.

How much does it cost to get a B2B client to a meeting?

Getting someone to actually sit down with you — even for a short meeting — can be expensive once you add everything up.

Across digital industries:

- Organic channels (SEO, content, brand): €30–80 per qualified meeting.

- Email outreach: around €100–150 per meeting, depending on personalization and data quality.

- LinkedIn outreach: €120–200 on average — high intent, but slower cycles.

- PPC (LinkedIn Ads, Google Ads, Meta): €200–400 per booked meeting, depending on the niche.

- Events and conferences: €400–700 per relevant conversation, considering travel and booth costs.

So if your average closing rate from meetings to signed deals is 10%, your cost per acquisition may end up 10× higher than your cost per meeting.

The reality of cold calling

Cold calling is still one of the most direct B2B sales methods — but its efficiency varies widely. Across industries, only 1–5% of cold calls lead to a sale.

That means if it costs you €20 per call attempt (considering time and overhead), you’ll spend €400–2,000 per successful sale — even before delivery costs. In industries with longer decision cycles, this can climb even higher.

However, cold calling also strengthens brand recognition. Each call is a touchpoint that may improve conversion in later outreach or retargeting campaigns.

Even a rejected call plants a seed,” said one B2B sales manager. “Three months later, they often call back.

Industry variations

CAC differs drastically depending on your digital niche:

- SaaS: usually €200–600 per customer, depending on product complexity.

- Marketing agencies: €300–800, since deals rely heavily on trust.

- Consulting and IT services: €400–1,200, with long cycles but high contract values.

- E-commerce B2B: €100–250, faster conversion but thinner margins.

High-value industries tolerate higher CAC because of strong lifetime value (LTV) — a €1,000 CAC is fine if each customer brings €10,000 in long-term profit.

The hidden cost of time

Sales cycles in B2B average 84–120 days, depending on deal size. Every delay adds indirect costs — from unproductive follow-ups to idle sales hours. That’s why streamlining early contact and qualification is crucial for keeping CAC under control.

Reducing CAC with smarter meetings

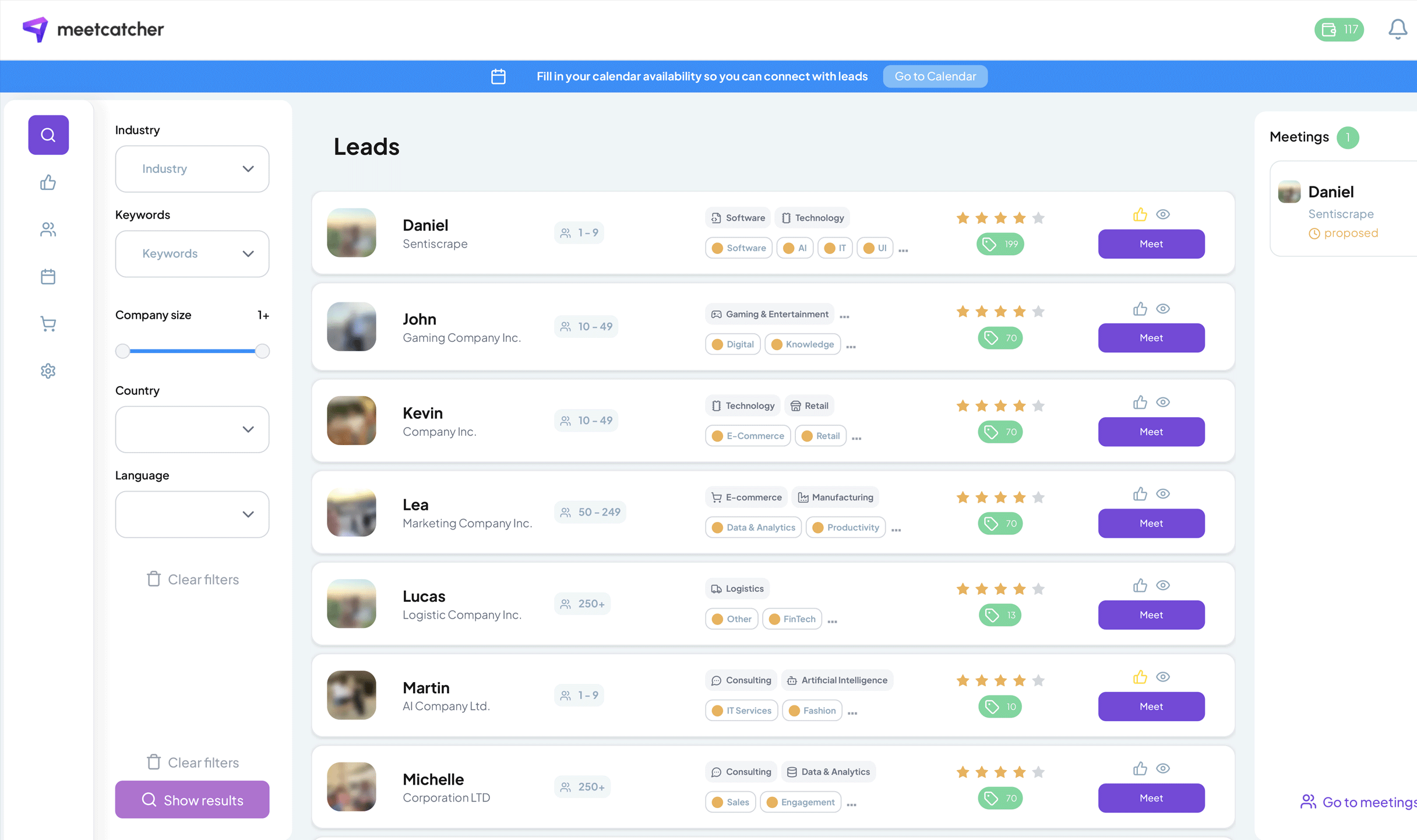

One effective way to lower acquisition costs is to reduce the friction in getting to the first meeting. That’s exactly what tools like Meetcatcher are built for.

Meetcatcher connects you directly with new potential B2B clients — not leads you already know, but fresh opportunities open for conversation. Instead of spending hundreds on ads or cold outreach, you can instantly match and meet with decision-makers through short, focused video calls.

It’s a faster, leaner path to business relationships — and a smarter way to bring your CAC down without cutting quality.

Final thoughts

Calculating customer acquisition cost isn’t just an accounting exercise — it’s a mirror of your efficiency. By understanding where your money and time go, you can optimize your mix of marketing, outreach, and meetings.

The goal isn’t just to make CAC smaller — it’s to make every euro you spend work smarter toward a repeatable, profitable growth model.