What Does It Cost to Acquire a B2B SaaS Customer?

How much should you expect to pay to acquire a B2B SaaS customer in 2025? The honest answer is: it depends on your product’s price, time-to-value, and how much you can afford to invest up front. CAC is not just a channel number; it’s a business constraint derived from gross margin and lifetime value (LTV). If your LTV supports a 3:1 LTV:CAC ratio, you can spend more and still grow responsibly; if not, paid acquisition may look great in clicks and terrible in cash.

The two variables that actually decide your CAC

- What you sell (and to whom). High-urgency tools with clear ROI convert faster and cheaper; low-frequency tools need more education, which raises CAC.

- What you’re allowed to spend. Work backwards from LTV and gross margin. If LTV is €1,800 with 80% margin, your economic CAC ceiling might be ~€480 (assuming a 3:1 LTV:CAC and leaving room for overhead). If your funnel can’t hit that, rethink either pricing, positioning, or channels.

A pragmatic way to decide if paid is viable: calculate the allowable CAC, then compare it against realistic channel CACs (not optimistic ones).

Pessimistic (but realistic) 2025 media costs

Costs vary by niche, but here’s a conservative, slightly negative range many B2B SaaS teams actually see:

- Google Ads (Search, B2B intent): CPC ≈ €3.50–9.00, with competitive niches peaking above €12.00.

- LinkedIn (Feed clicks): CPC ≈ €5.50–14.00; lead gen forms often convert better but still imply a higher final CAC.

- Instagram (Feed/Reels clicks): CPC ≈ €1.20–2.80; cheaper traffic, but lower in intent.

- Display remarketing (various networks): CPM ≈ €7.50–18.00; works best as an assist, not as the primary engine.

These are only the click or view costs. The question that matters is: what fraction turns into paying customers? That’s where funnel math decides everything.

The funnel reality: how many sign-ups you need for one paid user

Let’s model a conservative self-serve SaaS funnel (registration → trial → paid). To keep it honest, we’ll use decimal ratios and a slightly pessimistic stance:

- Visit → Registration: 0.035 (3.5%).

- Registration → Trial started: 0.70 (70.0%).

- Trial → Paid: 0.22 (22.0%).

End-to-end: 0.035 × 0.70 × 0.22 = 0.00539 → roughly 0.54% of visitors become paying customers.

Now translate that by channel:

Example 1: Google Ads

- CPC €5.50; 1,000 clicks cost €5,500.00.

- At 0.54% paid, that’s 5.39 customers.

- Blended CAC (media-only): €5,500.00 / 5.39 ≈ €1,020.41 per customer.

Example 2: LinkedIn

- CPC €9.20; 1,000 clicks cost €9,200.00.

- 5.39 customers → CAC ≈ €1,706.86.

Example 3: Instagram

- CPC €2.10; 1,000 clicks cost €2,100.00.

- 5.39 customers → CAC ≈ €389.61 (but beware: maintaining this assumes your landing page and offer convert IG traffic near the same 0.54%, which is often optimistic; real CACs drift higher if intent is weaker).

Takeaway: CAC is a function of intent. Expensive clicks with strong intent (Search, LinkedIn job-title targeting) can beat cheap clicks with weak intent—if your pages and onboarding capture that intent.

What “good” looks like (benchmarks without the hype)

Expert benchmarks across B2B SaaS in 2025 commonly show:

- Signup rate on focused landing pages: 2.5–5.0%; >5.0% when the offer is laser-aligned.

- Trial start rate from signups: 0.60–0.85, depending on friction and clarity.

- Trial-to-paid for SMB self-serve: 0.18–0.32; sales-assisted often rises with demos.

- Sales cycle for sales-assisted SMB: 45–90 days; mid-market: 90–180 days.

- Healthy LTV:CAC: 3.0–5.0; less than 3.0 stresses cash, more than 5.0 suggests under-investment in growth.

Channel cost comparison from the field

One sales leader compared cost per marketing-qualified lead (MQL) across their stack:

- Organic/SEO & referrals: about €50.00 per MQL.

- PPC and outbound outreach: about €150.00 per MQL.

- Conferences/events: about €250.00 per MQL.

Their conclusion: outreach costs about the same as PPC, but compounds relationship-wise (warmer future calls, better reply rates). This is typical: organic is cheapest but slow; paid and outbound are pricier but controllable; events are costly but can lift brand and pipeline quality.

A rep who ran both a “pure cold” motion and a “preheated” motion (social touches + remarketing) saw meeting rates improve by 20–35% once buyers had prior exposure. That brand lift cascades into lower CAC.

Small levers that move CAC a lot

- Raise allowable CAC via monetization. Upsell packages, annual plans, or minimum seats can lift LTV by 15–40%, instantly giving paid channels more headroom.

- Tighten ICP and messages. Improving visit→registration by +0.006 (e.g., from 0.035 to 0.041) often lowers CAC by 20–30% on its own.

- Add remarketing. Even a modest program can push trial→paid from 0.22 → 0.27, cutting CAC another 15–25%.

- Shorten time-to-value. A 90-second guided demo or a prefilled dataset can nudge trial starts from 0.70 → 0.78.

What it looks like when everything clicks

Imagine you layer in remarketing and improve the offer:

- Visit → Registration: 0.041

- Registration → Trial: 0.75

- Trial → Paid: 0.27 End-to-end: 0.041 × 0.75 × 0.27 = 0.00830 → 0.83% paid.

Re-run the CAC examples with this improved funnel:

- Google Ads (CPC €5.50): €5,500.00 / 8.30 ≈ €662.65.

- LinkedIn (CPC €9.20): €9,200.00 / 8.30 ≈ €1,108.43.

- Instagram (CPC €2.10): €2,100.00 / 8.30 ≈ €253.01.

That’s why tiny percentage lifts at each step matter more than heroic top-of-funnel spend.

Sales assist lowers CAC more than you think

Self-serve funnels are great, but a 10–15 minute discovery call during trial can double paid conversions for complex tools. The fastest way to test this isn’t another nurture email; it’s inviting users to short qualification calls right when interest peaks. Teams that route trial users into quick human chats often raise trial→paid by +0.05–0.12 absolute.

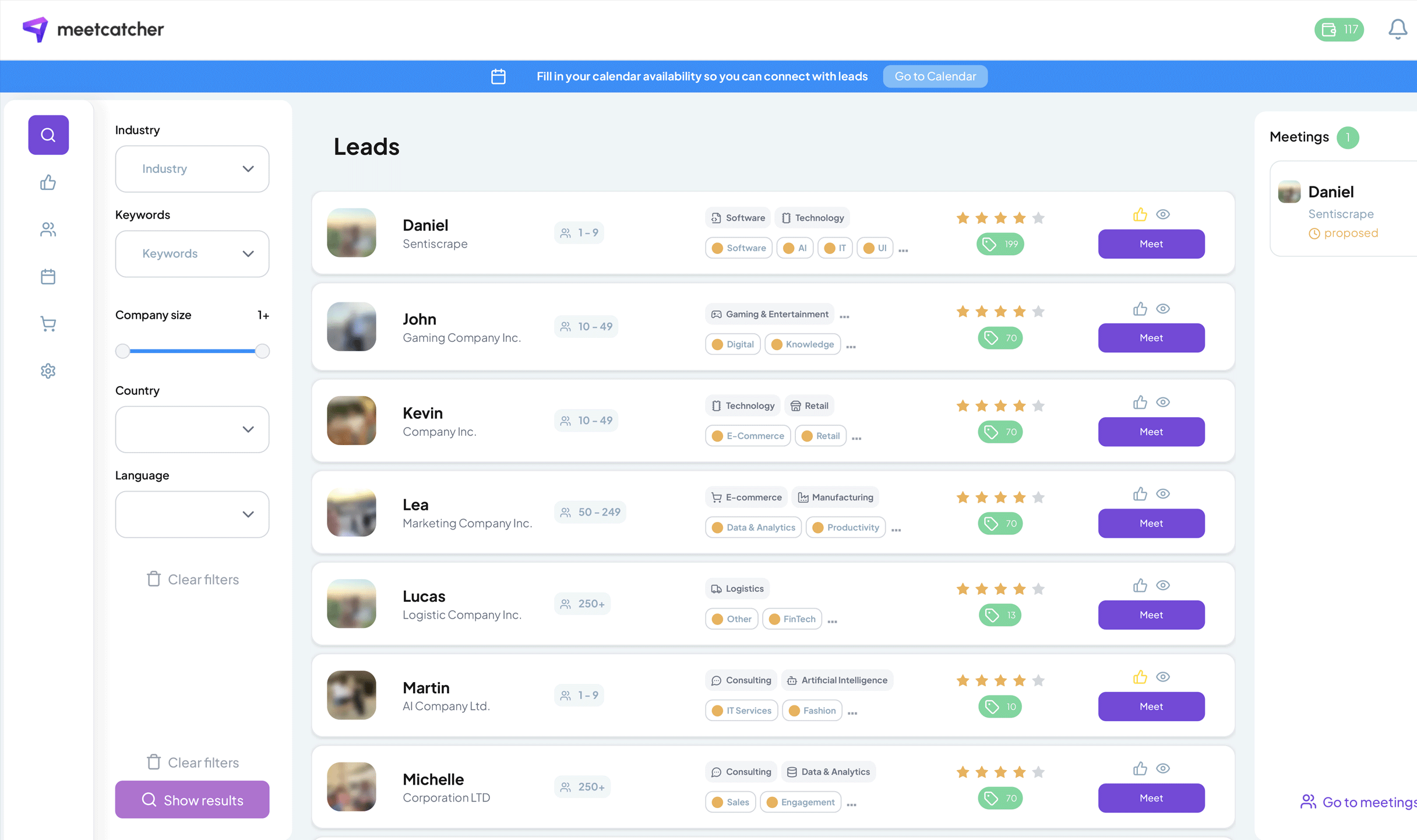

Modern tools now go beyond funnel tracking — they help you start real conversations with new prospects. Platforms like Meetcatcher connect SaaS founders and sales professionals with potential B2B buyers and let them instantly book short video meetings. It replaces the slow back-and-forth of LinkedIn messages or emails, turning a cold lead into a live business opportunity.

Putting it all together: a simple plan

- Set your allowable CAC. Start from LTV and margin; pick a 3:1 or better target.

- Pick 2–3 channels that match your ICP’s intent (Search + LinkedIn for precision; Instagram for cheap remarketing and awareness).

- Instrument the funnel (visit→reg→trial→paid) and accept a pessimistic baseline for the first month.

- Run weekly experiments to raise each step by +0.003–0.010 absolute (copy, offer, social proof, demo-in-advance).

- Blend brand with outbound. Preheat contacts via posts/remarketing; expect 10–30% relative gains in meeting rates and lower CAC.

- Route to short calls at moments of highest intent; use a zero-friction scheduler to protect momentum.

Final thought

There isn’t a single “right” CAC number for B2B SaaS. There’s only the right CAC for your unit economics, reached by matching intent to message and by tightening each step of the journey. If your current math says paid is too expensive, that’s not a failure — it’s a roadmap: improve conversion, lift LTV, warm the audience, and try again with discipline. The cheapest customer isn’t the one with the lowest click cost; it’s the one who understands your value the fastest.